Table of Content

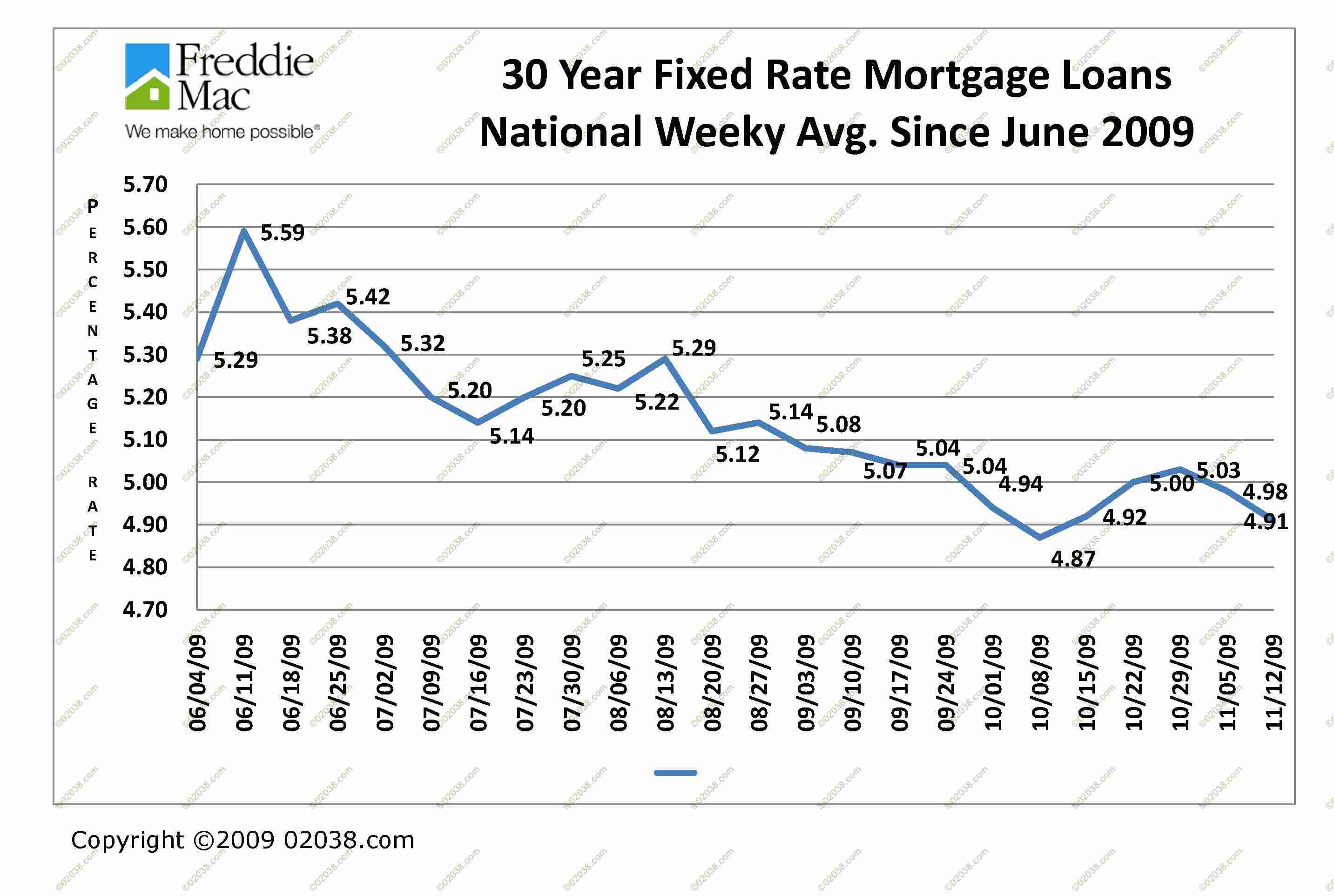

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. As of Thursday, December 22, 2022, current rates in Texas are 6.55% for a 30-year fixed and 5.89% for a 15-year fixed. Whether they are looking in Dallas, Houston, Austin or El Paso. Mortgage deals to meet your needs will not be hard to find. The company announced its newest program, Opendoor Home Loans, on Thursday, promising it would make the process of securing a.

You can usually choose from a 10-, 15-, 20- or 30-year fixed-rate loan. Generally, the longer the repayment period, the higher the mortgage rate will be. Conventional mortgages refer to home loans that are not backed by the government. Most borrowers prefer this type of mortgage because it requires fewer documentary and eligibility requirements. It can also be used to purchase most types of real estate, like investment property.

Exxon Mobil’s Irving headquarters sells to Austin investor

He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more. Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credible’s online tools to compare rates and get prequalified today. Qualified applicants can get a Texas Mortgage Credit Certificate that will give them a tax credit when they file their federal income taxes. Remember that a tax credit is a dollar-for-dollar reduction in your tax liability .

If you are ready to buy a home, getting pre-approved for a home loan is the place to begin. There are a variety of mortgage options available, each with different benefits for potential home buyers. Speak with a licensed mortgage expert on our team about your goals and your best mortgage options. Additionally to the median home price falling by nearly 1.5%, the total number of home sales was lower in the month of November. A total of 22,983 home sales were reported in November compared to the 26,105 home sales in Texas reported in the month of October.

Texas Mortgage Taxes

Real estate experts foresee prices continuing to rise, but at a slower pace. Home prices in the state of Texas have been steadily increasing since 2012, according to recent property data, which shows the median home value to be roughly $170,000 in the Lone Star State. The median list price of an occupied home on the market is $100,000 higher than the median value. If your home closing will take longer than the normal periods, then you should avoid locking in the rate too soon. If your loan doesn’t fund within the time frame you locked it for then your rate lock offer will expire. You must therefore ensure that the length of your lock-in will allow the lender sufficient time to process the loan.

One way to do this would be to research and read online reviews provided to the lender by past customers. This continuous rise in mortgage rates will impact the homeowners and borrowers equally. Still, keep in mind that you need to have good credit to take out a conventional loan.

Governmental Finance Programs Programs

Plus, advice is totally free and your dedicated expert can search the market, help you get mortgage ready and will be on hand to talk things through when needed. The Home Sweet Texas program offers low- to moderate-income Texans down-payment assistance as a grant or a forgivable second-lien loan. The down-payment assistance can equal up to 5% of your mortgage amount. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site .

A mortgage enables the dream of home ownership in Texas come true, but mortgage rates in Texas can fluctuate so be sure and visit with a loan specialist about locking in your best rate today. If you’re looking to buy a home or investment property in Texas, then we hope to have a chance to earn your business. Current 2022 mortgage rates in Texas have gone up almost a point since the start of the year and analyst predict rates will continue to rise through July, 2022. For the majority of buyers, it makes sense to initially enter into a purchase agreement for a particular piece of real estate before making an effort to lock in a mortgage rate. Mortgage rates can ONLY be locked against a property you plan to purchase. For example, if you find a property that you are willing to purchase and move forward to lock the rate but then decide to purchase another property instead, now the rate lock is not transferable.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. So, if you only have 20% equity in your home you won’t be allowed to get a home equity loan at all because the mortgage debt on your home is at that 80% cut-off. You can calculate the home equity loan you can legally have on your home by multiplying the home’s value by 0.8 and then subtracting the amount you still owe on the home.

The state's large area presents many options that can please different types of buyers. The lowest prices will be found in the Southwest, along the state's border with Mexico. Although home values increase moving north, excellent values can still be found, especially when compared to median incomes.

The September figures indicated three consecutive months of annual price growth decreases in DFW. The S&P CoreLogic Case-Shiller Index reports that Dallas-Fort Worth home prices rose more than 16% in September, compared with September 2021. But that’s also a drop from a 31% increase from April 2021 to April 2022. Here is everything you need to know about reverse mortgages & cash-out refinance. We will not sell your personal information but might offer an excellent rate every now and then on various ad platforms. But if you're still uncomfortable, you may opt out by using the link Do not sell my personal information.

Foreclosures can be either judicial or non-judicial in Texas. If you have a traditional mortgage document your lender will probably have to go through judicial foreclosure to reclaim the home and this can be a lengthy process. You may instead have a deed of trust, which allows the lender to do a “power of sale” foreclosure. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear.

Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. Texas does not charge income tax, but they offset the lack of income tax by charging relatively high property taxes. The higher property tax rates help hold down real estate prices during booms which in turn makes Texas real estate less cyclical than states like California. The average tax rate across the state is 2.06%, costing homeowners around $4,660 per year. In Austin average property taxes cost an average of $7,012 per year. Before you apply for a mortgage, compare interest rates from multiple lenders.

E.g. 30 year fixed, 15 year fixed, 10 year fixed, 5/1 Year ARM and etc. As the name suggests, the Homes for Texas Heroes program provides down-payment assistance grants or forgivable second-lien loans to those who work to help others. Teachers, police officers, firefighters and emergency medical services personnel, corrections officers and veterans are eligible, even after buying their first home.

The mortgage is underwritten by a private mortgage company, and the VA insures the loan. Census Bureau show a median home value in Lubbock of $114,000. According to recent property data, the median home value in the city is a slightly higher $122,000. This figure represents an increase of 3.8% from previous data.

However, Conroe's northern location did not spare it from significant damage after Hurricane Harvey swept through the region. Some homes in Conroe had up to 20 inches of flood water inside. There is no reliable way to estimate home values at this time, and it will take many years for the property market in the Houston area to recover. Flooding damage from Hurricane Harvey is likely to lead to home supply shortages, as 242,000 homes were in or very near known flooded areas.